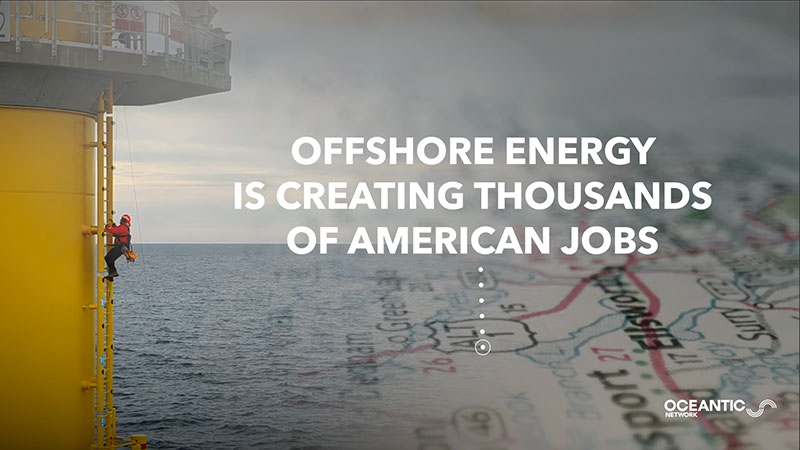

Offshore wind energy is revitalizing American industries, creating thousands of jobs across the country in shipbuilding, steel manufacturing, port facilities, and more.

2024 was a year of great progress for the U.S. offshore wind energy industry. South Fork Wind (NY) became the country’s first operational commercial wind farm, and the Coastal Virginia Offshore Wind Project, Revolution Wind (CT and RI), and Vineyard Wind 1 (MA) projects began installation on the East Coast. These projects, and the supply chain that supports them, have created thousands of jobs in communities stretching from America’s heartland to its coastlines, engaging every part of the offshore wind supply chain, from shipbuilding and steel manufacturing to port development and the construction trades.

$25+ Billion Invested

in the Supply Chain

Companies in 40

States with Contracts

15+ GW

Under Contract

Watch Offshore Wind Manufacturing and Innovation in Action

American Jobs in Offshore Wind

Oceantic Jobs Tour

To recognize the incredible work being done by Americans nationwide, Oceantic Network kicked off our U.S. Jobs Tour in summer 2024. Along the way, we’re collecting videos, photos, and interviews of people and projects, showcasing the ingenuity, hard work, and innovation of American companies supporting our nation’s economy and energy independence. The economic benefits and job creation alone are remarkable, and the success we’ve already seen is just the beginning for the energy industry of the future.

In Palatka, Florida, St. Johns Ship Building, Inc. has constructed and delivered three Crew Transfer Vessels (CTVs) for use in offshore wind construction and maintenance. Two more of these vessels, a 30-meter and a 24-meter, are still under construction at the yard, which has invested in new streamlined processes and an in-house aluminum welding training program. Jim Cutts, Johns CTV Program Director, said these changes have allowed them to increase efficiency, standards, and building speeds at the yard.

In Palatka, Florida, St. Johns Ship Building, Inc. has constructed and delivered three Crew Transfer Vessels (CTVs) for use in offshore wind construction and maintenance. Two more of these vessels, a 30-meter and a 24-meter, are still under construction at the yard, which has invested in new streamlined processes and an in-house aluminum welding training program. Jim Cutts, Johns CTV Program Director, said these changes have allowed them to increase efficiency, standards, and building speeds at the yard.

The State of New York is home to the nation’s first commercial-scale offshore wind project, South Fork Wind, and the state’s manufacturing supply chain has ramped up to support the industry. During our visit, Network staff followed the journey of turbine components across the state. Steel procured from states like Kentucky and Pennsylvania is brought to

The State of New York is home to the nation’s first commercial-scale offshore wind project, South Fork Wind, and the state’s manufacturing supply chain has ramped up to support the industry. During our visit, Network staff followed the journey of turbine components across the state. Steel procured from states like Kentucky and Pennsylvania is brought to

Rhode Island is another hub for offshore wind vessels. Senesco Marine LLC’s shipbuilding and repair yard has played a key role in delivering Crew Transfer Vessels (CTVs) for East Coast offshore wind projects like South Fork, and offshore wind has played a key role in Senesco’s growth. Over the past year, offshore wind-related projects have accounted for 40-70% of Senesco’s work, and their permanent employment has evened out around 300 — up from about 160 in March 2022. Currently, Senseco is nearing the completion of its fifth CTV in just under three years, with another on the way. By all measures, Senesco’s commitment of time and money to offshore wind projects has been well worth it.

Rhode Island is another hub for offshore wind vessels. Senesco Marine LLC’s shipbuilding and repair yard has played a key role in delivering Crew Transfer Vessels (CTVs) for East Coast offshore wind projects like South Fork, and offshore wind has played a key role in Senesco’s growth. Over the past year, offshore wind-related projects have accounted for 40-70% of Senesco’s work, and their permanent employment has evened out around 300 — up from about 160 in March 2022. Currently, Senseco is nearing the completion of its fifth CTV in just under three years, with another on the way. By all measures, Senesco’s commitment of time and money to offshore wind projects has been well worth it. n May, several Oceantic team members visited Rhode Island and South Fork Wind as part of the Jobs Tour. They witnessed CTVs being constructed by Senesco welders in real-time, vessels that will support turbine construction and maintenance. They also had the opportunity to tour a former Gulf of Mexico oil vessel that Otto Candies has retrofitted into a service operations vessel (SOV), also known as a “floating hotel,” which supports maintenance crews over long periods of time.

n May, several Oceantic team members visited Rhode Island and South Fork Wind as part of the Jobs Tour. They witnessed CTVs being constructed by Senesco welders in real-time, vessels that will support turbine construction and maintenance. They also had the opportunity to tour a former Gulf of Mexico oil vessel that Otto Candies has retrofitted into a service operations vessel (SOV), also known as a “floating hotel,” which supports maintenance crews over long periods of time.

In Virginia, construction of Dominion Energy’s Coastal Virginia Offshore Wind (CVOW) is well underway, supported by the Portsmouth Marine Terminal where Dominion has leased 72 acres for its current project, as well as future ones. So far, marshaling and assembly work for the project has created 540 construction jobs and 1,000 operations jobs, including the construction of the Fairwinds Landing Maritime Operations and Logistics Center nearby.

In Virginia, construction of Dominion Energy’s Coastal Virginia Offshore Wind (CVOW) is well underway, supported by the Portsmouth Marine Terminal where Dominion has leased 72 acres for its current project, as well as future ones. So far, marshaling and assembly work for the project has created 540 construction jobs and 1,000 operations jobs, including the construction of the Fairwinds Landing Maritime Operations and Logistics Center nearby. The Midwest may seem a long way from offshore wind, but Fincantieri Bay Shipbuilding would beg to differ. Sturgeon Bay, Wisconsin has become home to the construction of new Service Operations Vessels (SOVs), one of the most important vehicles for offshore wind. SOVs serve as “floating hotels,” providing a home for workers during longer projects.

The Midwest may seem a long way from offshore wind, but Fincantieri Bay Shipbuilding would beg to differ. Sturgeon Bay, Wisconsin has become home to the construction of new Service Operations Vessels (SOVs), one of the most important vehicles for offshore wind. SOVs serve as “floating hotels,” providing a home for workers during longer projects.