From the Gulf Coast to the Great Lakes and the Delaware River, shipyards are churning out vessels for the nation’s next energy armada–America’s Offshore Wind Fleet. Thousands of welders are collectively manufacturing vessels that will survey, install, and maintain America’s newest, large-scale energy source that is destined to alleviate power supply and cost concerns. Development of this fleet is supporting thousands of jobs and anchoring long-term investments in ports, shipyards, and U.S. steel manufacturing. Together, these ships aren’t just essential to offshore wind, they are delivering new work to shipyards after years of limited newbuild activity, leading the way for a broader resurgence in American industrial capability, skilled labor, and supply chain strength.

In April 2025, President Trump signed the Executive Order on Restoring America’s Maritime Dominance, a directive aimed at revitalizing the U.S. shipbuilding sector, expanding the domestic maritime workforce, and strengthening the nation’s industrial base. Yet this revival is already underway. Over the past five years, offshore wind has been a catalyst for building and retrofitting more than 40 specialty vessels at American shipyards, with yet another 20 already in the queue. These vessels — from service operation vessels (SOVs) and mighty heavy-lift installation vessels to crew transfer vessels and cable-lay barges — are designed to operate under the Jones Act, ensuring they are built in America, by American workers, and with American Steel.

This summer marks a milestone in that story. Five capital-class, U.S.-built offshore wind vessels representing well north of $1.2 billion in new investments officially join the flotilla: the Acadia, Charybdis, ECO Liberty, MARMAC 306, and the industry’s third newbuilt SOV — yet to receive its name. Each represents months or years of work in shipyards across three coasts, employing welders, electricians, marine engineers, and skilled tradespeople. Collectively, they illustrate the offshore wind sector’s raw potential to stimulate shipyard activity, create well-paying jobs, and modernize the maritime energy task force in alignment with the nation’s priority to reestablish commercial maritime dominance.

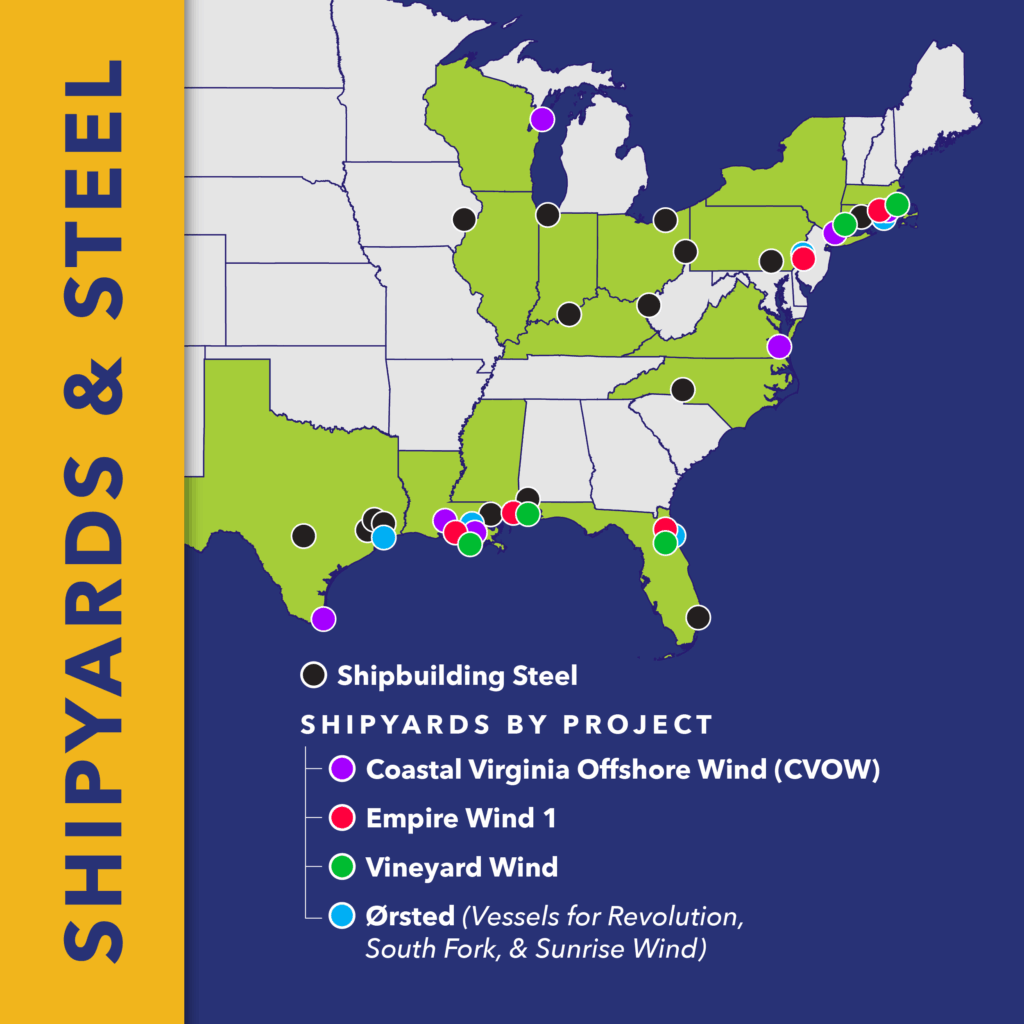

The economic impact extends far beyond the yard gates. Vessel construction supports steel fabrication shops, electronics suppliers, port facilities, and training programs in coastal and inland states alike. The ECO Liberty supply chain, for example, reached communities across 34 states––well beyond its shipyard in Houma, Louisiana. Its thousands of tons of steel were forged in Alabama, North Carolina, Texas, and West Virginia. Specialized American equipment makes up its many pipes and valves, watertight doors, electrical components, and massive engines. For communities across the Gulf Coast, the Great Lakes, and the Northeast, offshore wind is a new source of industrial activity that complements traditional shipbuilding markets and offers long-term growth potential.

The U.S. offshore wind market is still in its early stages, yet the demand for specialized vessels is already significant—and growing. Over the next two decades, dozens more vessels will be needed to build, operate, and maintain offshore wind farms along America’s coasts. With thoughtful policy alignment, this demand can serve as a steady, predictable pipeline of work for American shipyards, strengthening the very industrial base the nation aims to restore.

Oceantic Network, representing more than 400 companies in the offshore wind and maritime supply chain, is committed to telling this story. This “Summer of Ships” is more than a milestone—it’s a message. Offshore wind is aligning with national priorities to restore American shipbuilding, strengthen the industrial base, and modernize the fleet. For policymakers and maritime stakeholders, the takeaway is clear: the energy transition is also an industrial resurgence, and the proof is leaving the yard with American names on the stern.